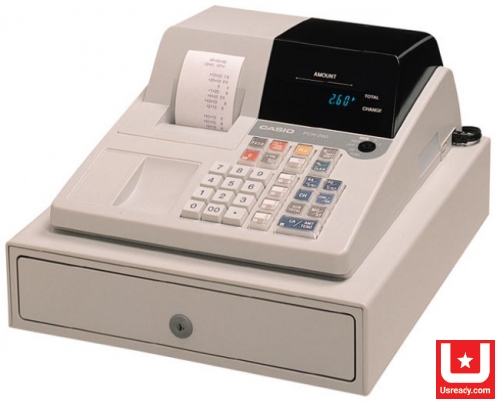

US READY - The American's No1 Manufacturer of Cash register

What are the advantages of a computerized cash register point of sale?

Your inventory control will be accurate: the point of sale system is capable of tracking the inventory of your stock much faster as well as much more accurately than the conventional cash register systems.

What are the advantages of a computerized cash register point of sale?

It speeds up the checkout process: the point of sale system interfaces with barcode scanners. This means it has the capability of scanning the barcodes at a faster rate and with a significantly less margin of error. This means your customers will spend less time at checkout which keeps the lines short and business moving much faster.

Barcode labelling: the cash register point of sale systems has the ability if printing barcode labels once you receive your new stock. These barcode labels are attached to your inventory thus making it much more convenient to keep tabs on your stock, to count your stock as well as to sell your stock.

Keep tabs on employee time cards: Some of the cash register point of sale systems even has the ability to track the times that your employees sign in as well as when they sign out. You can even find some that will come with the ability to scan the cards of your employees so as to keep accurate records of their working hours as well as tracking their wages.

Loyalty cards for customers: Point of sale software also comes with the ability to track your customers by keeping their records. The information that will be stored will include the customers’ names, their telephone numbers and so on. The great advantage of this is that you now have the chance of offering discounts to customers who use their cards frequently or perhaps you may simply want to keep track of the buying rends of your customers.

Accurate records: Since the data on the point of sale systems is digital, the details as well as the accuracy of the information are high. As such, it is much easier to keep track of sales of specific items in your inventory, track your customers’ data and so on. The reports that are generated by these systems tend to be far more superior to those generated by the traditional cash register systems. This is because the cash register point of sale system will have much more in depth information which makes it easier for you to sift through and get what you want.

You get to integrate your accounting: Most of the point of sale systems that are in the market can easily interface with popular accounting packages that are being used. This presents you with an easy and seamless way of conducting all your accounting needs in one place. The point of sale systems have the capabilities of importing as well as exporting files and this saves a lot of time and energy that would otherwise be spent on double entry of different types of data.

eCommerce integration: Just as the point of sale systems can easily be integrated with different types of accounting software, they can also interface directly with various eCommerce platforms as well as websites. This presents you with an organized as well as accurate way of maintain a connection between your online as well as offline stores.

5 Things to Consider When Choosing a Cash Register for Your Business

A cash register is a necessity for any product-based business that performs numerous transactions on a daily basis. Depending on a business’s needs, a cash register can range from basic, with limited features, to a comprehensive point of sale (POS) system with a long list of features.

5 Things to Consider When Choosing a Cash Register for Your Business

If you’re trying to decide which type of cash register is right for your business, we have outlined a few things for you to consider before making a purchase so you find the system that is a perfect fit for you.

- Consider your size and needs

The first thing to consider is how large your business currently is and your projected growth for the next few years. Perhaps you have thousands of items in inventory with several departments. Or you may be running a considerably smaller operation with only a few dozen items in inventory and a small shopping area.

It’s important to understand what you see for yourself now and in the near future so you can decide what your system needs are.

If your business is relatively large with numerous products, purchase a comprehensive POS system with a barcode scanner and product codes to streamline transactions. This is also a good choice if you foresee significant growth in the near future because this system offers scalability.

According to Experiment Central, these will typically cost anywhere from $5,000 to $20,000. On the other hand, a more simplistic cash register will probably suffice if you have minimal inventory, only a handful of transactions, and fewer overall needs. Chron Small Business puts lower end systems between $100 to $1,000.

- Look for security features

Keeping cash, checks, and electronic payment information safe is always a concern. That’s why it’s important to look for some fundamental security features.

A locking drawer will ensure that unauthorized individuals can’t gain access to cash and checks. You may also want to consider installing a cash drop box nearby so large sums of money can be safely stored. This will prevent the amount of cash in your register from exceeding a certain amount, which can deter both internal theft and robbery.

Also, a password feature will keep unwanted parties from using the cash register and accessing sensitive customer payment information.

- Explore benefits of inventory tracking

If your business only has limited inventory, then a basic cash register should suffice. Otherwise, when dealing with large inventory quantities, you can benefit from a more comprehensive POS system with an inventory tracking feature.

This will automatically monitor daily transactions so you’re always aware of exactly how many products you have on hand. Rather than performing inventory counts manually, this feature can save time and prevent you from running out of a particular product.

- Consider receipt printing options

Another issue to consider is whether you want to use a thermal or print ribbon cash register. The initial expense of a thermal printer is more expensive but can save money in the long run. Because they use heat to print receipts, you don’t have to continually buy new ink cartridges. A print ribbon printer is less expensive upfront and the text on receipts is clearer, but you will have the expense of ink cartridges.

- Decide if you want to buy from a retailer or a vendor

When looking for a basic cash register with minimal features, shopping at a retailer is usually your best bet and you may be able to find a quality register locally. Otherwise, looking online should yield plenty of options. Some business owners even shop secondhand and buy used models for even lower prices.

If you’re looking for a sophisticated POS system, it’s smart to buy directly from a vendor. They should offer several packages and pricing options to accommodate your company’s needs.

Pay attention to these guidelines to help you choose a cash register that fits both your business’s needs and budget. After implementation, you should notice increased efficiency in daily operations and speedier checkouts. This means more productivity and happier customers because they can complete transactions without issue.

>> See more: US Ready

How to Use a Cash Register

Cash registers are used to record payment amounts and to handle cash throughout the business day. There are multiple types of cash registers, including electronic registers, Square iPad cash registers, and other computer-based registers. While each register has some unique features, they all share similarities in their operation.

How to Use a Cash Register

- Part 1: Setting Up Your Cash Register

- Set up your cash register and plug it in

Find a hard, flat surface to set your register on. Ideally, this will be on a countertop with room for customers to place their merchandise. Plug the register directly into an outlet (do not use an extension cord).

- Install batteries

Batteries provide backup memory for the cash register in case of power failure and should be installed before you program any functions in the cash register.[1] Take off the receipt paper cover and locate the battery compartment. You may need to use a small screwdriver to unscrew the lid to this area. Install the batteries according to the directions on the machine. Put the lid back on the battery compartment.

Some battery compartments are located underneath the receipt paper area.

Change batteries once per year to ensure that they will work properly.

- Install the receipt paper

Take off the cover to the receipt paper compartment. Make sure the end of your paper roll has a straight edge so it will be fed easily into the paper feeder. Feed the paper roll through so that it will run up through the front of the register where you will be able to tear off receipts for customers. Press the FEED button so that the register will catch the receipt and feed it through.

- Unlock the till drawer

The till drawer usually has a key that locks it up for safety. Do not lose this key. You can just leave the key in the drawer when it is unlocked so that it is easily found when you need to lock it up.

- Turn the cash register on

Some cash registers have an ON/OFF switch on the back or side of the machine. Others may have a key on the front top of the machine. Turn on the machine, or turn the key to the REG (register) position.

Newer registers may have a MODE button instead of a physical key. Press the MODE button to scroll into a REG or operational mode.

- Program your register

Most registers have buttons that can be programmed to categorize similar items. These categories, or departments, can also be associated with taxable or non-taxable items. You can also set the date and time.

The program function is usually accessed by either turning the key to PRG or P, or pressing the mode button to PROGRAM. Other registers may have a manual lever underneath the receipt tape cover that needs to be switched to a Program option.

Many cash registers have at least 4 tax buttons. These can be programmed at different tax rates, depending on if you have a flat sales tax as some states in the U.S. do, or if you have other types of taxes, such as GST, PST, or VAT rates (depending on your location).

Follow the specific instructions in your register’s manual to program these functions.

- Part 2: Making a Sale

- Enter a security code or password to use the register

Many registers will require that you enter a clerk number or other security code to use the register. Clerk numbers are useful so that each sale is attributed to a particular person. This is helpful in tracking sales and clearing up errors.

If you work in a restaurant, you may need to enter your employee code along with the table number and number of customers.

Newer cash registers (such as the Square cash register) may require that you log in with an email address and password.

- Key in the amount for the first item

Use the number keys to type in the exact dollar amount of the item. Typically you do not need to add a decimal, as cash registers do this for you.

Some registers will use a scanner, rather than asking you to manually enter in item prices. The scanner will read a barcode and enter the product’s information automatically. If this is the case, you won’t need to press the department button in the next step.

- Hit the corresponding department button

Most registers require that you hit a button after the dollar amount that assigns that item to a category of sale (for instance, clothing, food, etc.).

Department keys can be programmed to be taxable or nontaxable. Consult your machine’s manual for instructions on programming tax rates to correspond with keys.

Looking at the receipt: press arrow or FEED key to have the register feed the receipt upwards so you can read what totals are being recorded on the receipt.

Every item you add on will be added to a running total, which is usually displayed on the cash register reader or screen.

- Add any necessary discounts to the price

If an item is on sale, you may need to enter in the percentage discount. Key in the price of the item, hit the department button, key in the discount percentage number (15 for 15% off, for example), and then press the % key. This key is usually in the bank of buttons to the left of the number pad.

- Key in amounts for the remaining items

Use the number keys to enter in the exact dollar amount for each remaining item. Be sure to press the corresponding department key after each item is entered.

If you have multiple copies of the same item, press the number of items, then the QTY button, then the price of a single item, and then the department key. For example, if you have 2 books priced at $6.99, press 2, then QTY, then 699, then the department key.

- Hit the subtotal button

This button will give the total of the merchandise rung up. It will add any necessary tax that has been pre-programmed into the department buttons.

- Determine how the customer is going to pay

Customers may pay in cash, with a credit card, or with a check. You may also accept gift cards or certificates, which are most often treated as cash.

Cash: Type in amount of cash they give you and press CASH/AMT TND button (this is usually the largest wide button on the bottom right hand portion of the register’s set of keys). Many registers will tell you how much change to give the customer. Some do not, however, and you will have to do the math in your head. Once the till drawer pops open, you can place the cash or check in the drawer and count out any necessary change.

Credit card: Press CREDIT button (sometimes CR) and use credit card machine to run the credit card.

Check: Key in the exact amount of the check, press the CK or CHECK button, and put the check in the drawer.

To open the till drawer if you have not made a sale, you can press the NO SALE or NS button. This function may be protected for manager use only and may require that a manager uses a key to put the register in a different mode to access the NO SALE function.

- Close the till drawer

Always close the cash drawer immediately after you use it so that it is not left hanging open. This could put you at risk for theft.

Always empty out or remove the till drawer at the end of the business day and store it in a secure place.

Part 3: Correcting Mistakes

- Void a sale.

If you have mistakenly entered in the wrong price for an item, or a customer decides they do not want to purchase an item after you entered it in, you may need to void the item or sale. This will remove it from the subtotal.

Type in an amount, press department key, press VOID (sometimes VD) button to remove it from the total. You must void an item before entering in a new item. Otherwise, you will need to subtotal the items, then press VOID, then press the exact amount you’d entered by mistake, and press the department key. This will subtract the incorrect amount from the subtotal.

If you need to void the entire sale with multiple items, go through each item and void each one.

- Refund a sale

If a customer wants to return an item, you need to account for that in the day’s cash totals before handing back money to the customer. To refund a sale, press the REF key, type in the exact amount of the item, and press the corresponding department key. Hit the subtotal button and then hit the CASH/AMT TND button. The till drawer will open and you can issue a refund to the customer.

Certain buttons and functions such as refunding money can be protected for manager use only. These might require that a manager uses a key to put the register in a different mode to use void or refund.

Check with your supervisor regarding the correct policy for handling returns and refunds.

- Stop the error sound

Some registers will beep or emit an error sound if keys are pressed in the wrong order or wrong combination. To stop the error sound, press the CLEAR or C key.

- Clear numbers that were entered incorrectly

If you have pressed the wrong numbers and have not hit the department button yet, press the CLEAR or C key to clear the numbers you’ve entered. If you already hit the department button, you will need to void the transaction.

- Part 4: Running Sales Reports and Balancing the Register

Using cash register

- Read running totals for the day

Some managers may want to check the sales totals periodically throughout the day. To read the running totals, turn the register key to X or press the mode button and scroll to the X option. Press the CASH/AMT TND button. Your daily sales totals thus far will print out on a receipt.

It is important to remember that X will read running totals, while Z will reset the daily totals.

- Run an end-of-day sales report

At minimum, this report will tell you the sales totals for the day. Many cash registers will also report hourly sales, sales by clerk number, sales by department, and other reports. To run these reports, press MODE key and scroll to the Z mode function or turn the key to Z to run report.

Remember that running the Z report will reset the cash register’s totals for the day.

- Balance the cash register

After running the sales report for the day, count out the money in the cash drawer. If you have checks or credit card receipts, add these into the total. Most credit card processing machines will also run daily total sales reports, so that you can easily reconcile your daily sales totals. Subtract your overall total from the amount of money that you started with before your first transaction of the day.

Put all your cash, credit card receipts and checks into a deposit bag and take them to the bank.

Keep a written ledger of the currency, credit card transactions and checks. This will help with your overall accounting.

Replace a base amount of money to the drawer for the start of the next business day. Be sure to store the money in a safe, secure location when your business is not open.

Posted by Uyên Vũ Tags: business, Cash register, inventory tracking, retailer, security features, The American's No1 Manufacturer, US READY, vendor